Understanding mental health

Causes and signs to look out for, whilst knowing how to access help, could be the difference between make and break for those around and, perhaps, even ourselves.

share:

South Africa is abuzz with the introduction of the new ‘two pot system’ that allows retirement fund members to withdraw a portion of their savings from their retirement investment. Media articles abound with statistics on the number of retirement fund members drawing from their savings pot under the new system. Following on this are warnings from insurers, in particular, that withdrawing from your savings account is very bad for your retirement.

These are the same insurers that have been selling retirement annuities (RA’s) to the public for many years. Yet, many of these retirement products are unnecessarily complex and come with more bells and whistles than a circus on parade. It seems to me that these bells and whistles are important because they serve to distract investors from the hideously expensive fees that they are being charged by insurers.

Now, while such insurers are quick to show retirement fund members the destructive impact of the two pot withdrawal on their retirement capital, they have been rather slow in telling RA investors about the negative impact of the high fees they levy

on someone’s retirement capital. I was recently asked whether a lump sum withdrawal would have more of an impact on someone’s retirement investment than their having to contend with a few extra percent in associated fees?

Well, the simple numbers simply do not lie. Here’s why…

Consider Member A and B. Both are 40 years old. Both have R300,000 in their retirement annuity. And, both will retire at age 60.

Let’s see how things stack up with both members being able to decide whether they want to access their maximum two pot seed capital withdrawal of R30,000, or, not.

With their retirement 20 years off, Member A chooses to withdraw his maximum of R30,000 in his savings pot from the R300 000 he has accumulated in a cost effective, ‘new generation’ RA. Member B, on the other hand, elects to heed the dire warnings of his insurer and decides not to withdraw the R30,000 available to him in his savings pot.

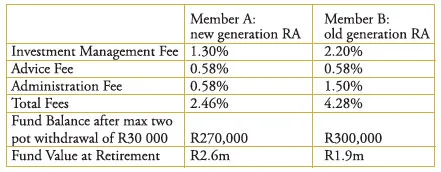

A simple calculation shows the typical pricing of a new generation RA against that of an expensive RA with all their unnecessary complexities, bells and whistles.

An important assumption in the calculation is the long-term return of the different RA’s. For the purposes of the comparative illustration, I have assumed that the funds will both return 12% per annum which is a reasonable assumption for a High Equity Balanced Fund, a suitable investment for someone who is 25 years away from retirement age.

Now, let’s deduct the total fees of each of the different types of RA’s from the returns each will generate. Even having withdrawn the maximum R30 000 from his savings pot, Member A earns 9.54% per annum after all fees have been deducted and should reach retirement age with R2.6m in his RA. However, Member B who did not make a withdrawal but was unfortunately invested in an expensive RA retires with only R1.9m in his RA.

Again, the numbers do not lie. The fees have significantly more of an impact on the performance of an RA than choosing the withdrawal from the savings pot. But, don’t get me wrong. I am not advocating for the gratuitous withdrawal by anyone of their retirement capital. I am merely highlighting the hypocrisy at play. Retirement fund members must ensure that they understand all the factors that impact their retirement capital. And, not just the one that’s on everybody lips right now!

Causes and signs to look out for, whilst knowing how to access help, could be the difference between make and break for those around and, perhaps, even ourselves.

Yoga is an ancient practice with roots in India that continues to grow in popularity amongst across the world. It’s easy to see why.

There’s nothing like escaping the rat race by getting back to Nature and experiencing all that the great outdoors has to o er!

This month we’re giving a few lucky subscribers free tickets to a movie of your choice at a Ster Kinekor theatre near you!

Just click the ‘SUBSCRIBE’ button & start enjoying the best of Local Life & our exclusive subscriber offers & experiences.

Subscribe now to get the full ‘Local Life’ magazine in your inbox and be the first to receive our fantastic subscriber special offers!